marekuliasz/iStock Editorial via Getty Images

Home improvement stocks have been pretty awful this year, which one can understand when considering interest rates have remained elevated, and therefore housing has been weak. There’s some merit to this, of course, as home improvement stocks tend to benefit from new home construction, and we know from the Great Recession that slower residential construction is bad news for home improvement stocks.

Lowe’s (NYSE:LOW) has always operated in the shadow of HomeDepot (HD), which has simply been the better stock over time, and remains so. Lowe’s is seeing a number of headwinds for the stock and at this juncture, while it’s cheap, I think it’s cheap for a reason.

The last time I covered Lowe’s was about a year ago, and I slapped a buy rating on the stock. It’s about flat since then, but for what it’s worth, that’s still ~10% better than the S&P 500. Not exactly a home run, but any time we can beat the market, that’s a win. What’s changed is that interest rates are massively higher than they were, which is bad for home improvement stocks, generally.

Looking for a bounce, but not much more

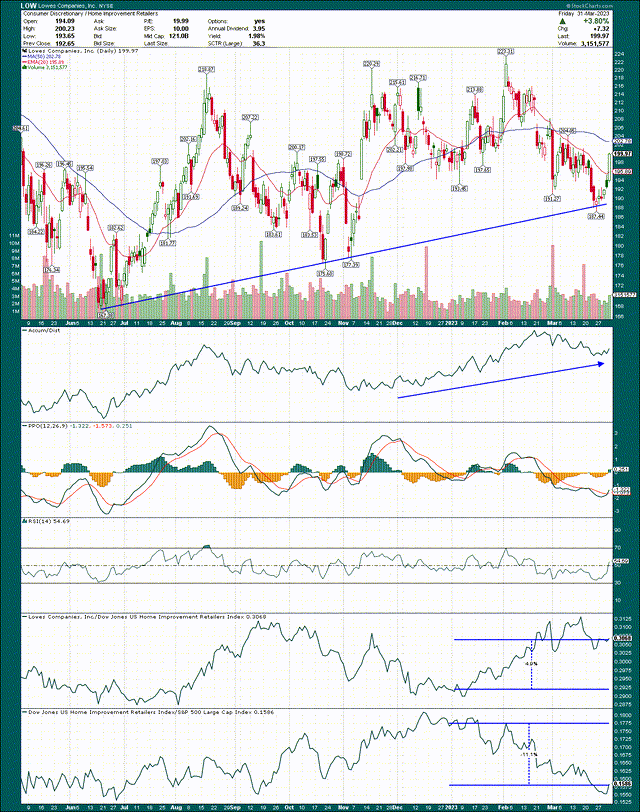

Let’s start with the chart, which I’m not exactly enamored with, but we could see a bit of short-term bullishness.

StockCharts

I’ve drawn in an uptrend line that was tested a few days ago, and quite successfully. That’s a good development for the bulls, and the rally on Friday put the stock well ahead of the 20-day exponential moving average. Resistance of the 50-day simple moving average looms overhead, so we’ll see what happens when/if the stock gets there.

If we look for clues as to the long-term direction, the accumulation/distribution line looks good. This indicator measures whether there’s money buying dips or selling rips, and Lowe’s is firmly in the former category. That’s a good development for bulls.

The PPO is well below the centerline, but is bouncing. I don’t like the look of the PPO and in no way is it bullish, other than to potentially support a short-term bounce.

Finally, the bottom two panels show relative strength, with the first showing Lowe’s against its peers, and the second showing its peers against the S&P 500. Lowe’s has been +5% to its peer group this year, while the group is -11% to the S&P 500. Lowe’s is a nice house in a bad neighborhood, so to speak.

Cause for concern

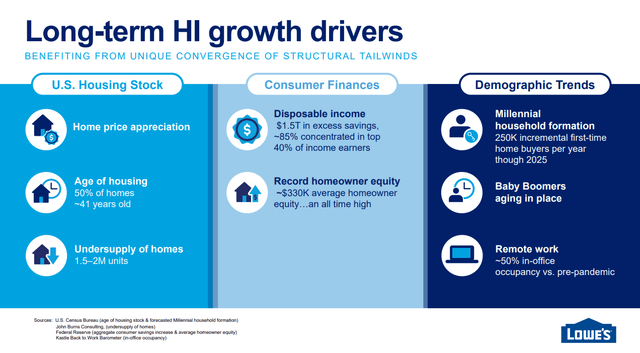

If we look at Lowe’s (or any home improvement stock), there are strong, long-term drivers of growth.

Investor presentations

Housing in the US is old in many parts of the country, and Lowe’s reckons there should be 1.5 to 2 million additional houses to support demand. Whether that’s true or not, general repair and improvement of existing homes is a tried and true, proven long-term driver of demand for Lowe’s and others.

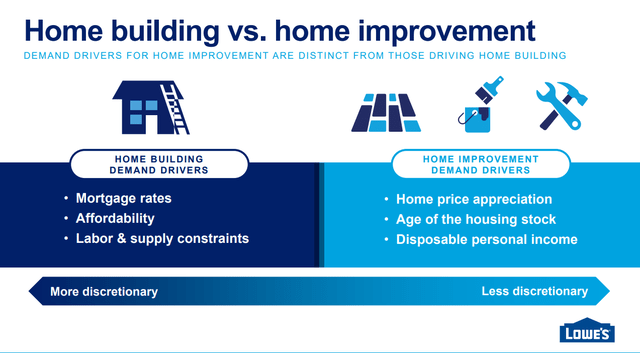

Investor presentations

I mentioned above that home construction is a concern for Lowe’s, but there’s plenty of home repairs and improvements, which are far less discretionary, and therefore, less susceptible to a recession in demand. These are long-term drivers of revenue, but we have to consider that the stock was/is priced for more than just baseline home improvement demand. I happen to think that’s where we are today, and below, we’ll take a look at why.

Pessimism abounds

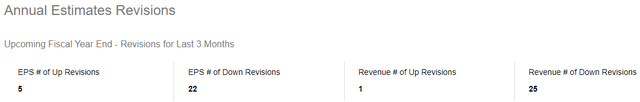

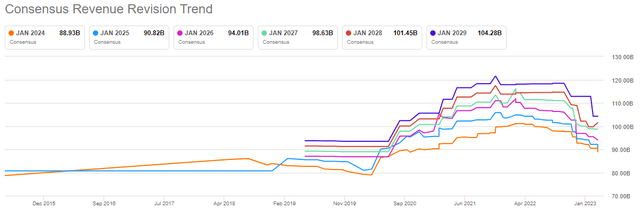

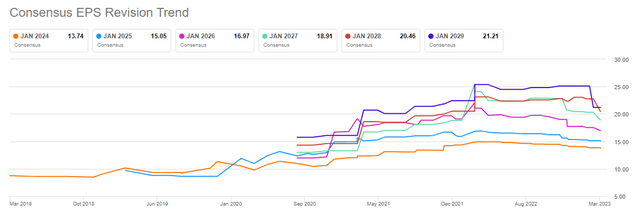

My favorite way to assess sentiment on a stock is to look at analyst estimates, and below, we can see they are overwhelmingly negative for Lowe’s.

Seeking Alpha

There have been 27 revisions in the past three months to EPS, and 22 of them have been down. It’s even worse for revenue, at 25 of 26 being lower. Sentiment is absolutely horrible right now and what that means is that any kind of valuation metric is worsening. In other words, whether you’re valuing the stock using some sort of sales metric or the traditional earnings, the denominator of those valuation metrics is falling, and the share price generally follows. In addition to that, with tough sentiments like this, we generally see investors as less willing to chase the stock higher, because of that valuation issue. This is a big headwind.

Seeking Alpha

Just how bad is it? These are not small revisions lower. We’re talking about $10+ billion in downward revisions for this year, and similar out of year revisions. For a business that has relatively slim margins (more on that below), these sorts of revenue revisions are painful.

EPS revisions have been somewhat better, but this is hardly bullish.

Seeking Alpha

So long as these lines are moving down and to the right, I think the bull case for Lowe’s is hard to make.

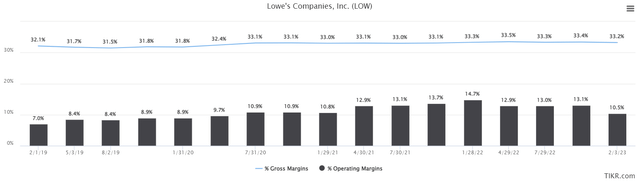

We know revenue is declining rapidly, but margins are also headed in the wrong direction, and have been for a while. Below we have gross margins and operating margins on a trailing-twelve-months basis, and again, the story isn’t great.

TIKR

Gross margins are generally pretty flat for home improvement stocks as they sell commoditized products, so their pricing power is weak. That makes the focus on SG&A costs and other items that impact operating margins (besides gross margins) more intense. We can see operating margin peaked at 14.7% of revenue five quarters ago, but has absolutely fallen off a cliff. In fact, the most recent reading is right back where it was at the end of 2020. It’s very difficult to make a bullish argument with this data looking the way it does.

A low valuation, but probably justified

If we put a proverbial bow on all of this, we have a stock with rapidly declining revenue and earnings estimates, the structural headwind of higher interest rates is thought to impact housing construction going forward. The chart looks okay short-term, but I’m unwilling to commit capital based on the technical picture at the moment.

The one thing we haven’t touched on thus far is the valuation, so below, we have five years of price-to-forward earnings data for some context.

TIKR

The stock is 14.6X forward earnings today, which is well below the 17.4X mean of the past five years, but remember that the bulk of that five years had much more favorable conditions for construction and home improvement. We can see the valuation is getting worse in the past several months as estimates decline, and that’s the issue the bulls face.

So long as estimates for revenue and earnings are falling, there’s no way to see much improvement in this chart, and that’s bad news for the stock.

What we have here is a mixed bag, and therefore, while I certainly don’t want to buy it, it’s not a short one either. I’m putting a hold rating on Lowe’s at the moment, as I think your capital is better served elsewhere.